Puffing outward

I’ve been struggling with the text for the Expand action. An abortive version of the current not-so-good stab follows:

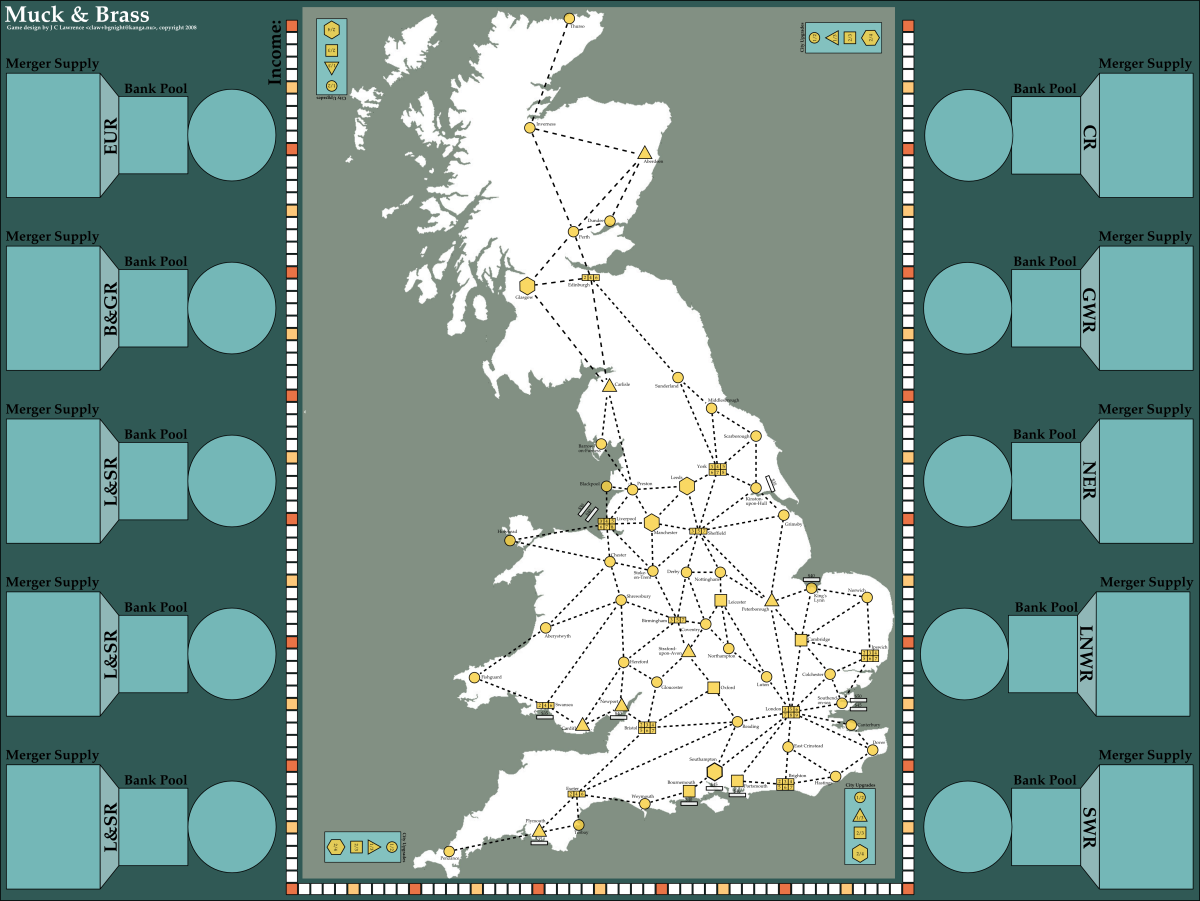

The Expand action connects cities and foreign ports to railway companies.

General restrictions on Expansion:

-

A player may only choose the expand action for a company if they own a share of that company

-

Expand may not be selected for a company with insufficient funds

-

Only one company may build a given route (dashed line) between cities

-

Companies indicate the city connections and foreign port connections they’ve built with route markers

-

The first route a company or merged component-company builds must connect to its home station. Subsequent routes may connect to the home station or to any city already connected by the (component-)company’s railway track

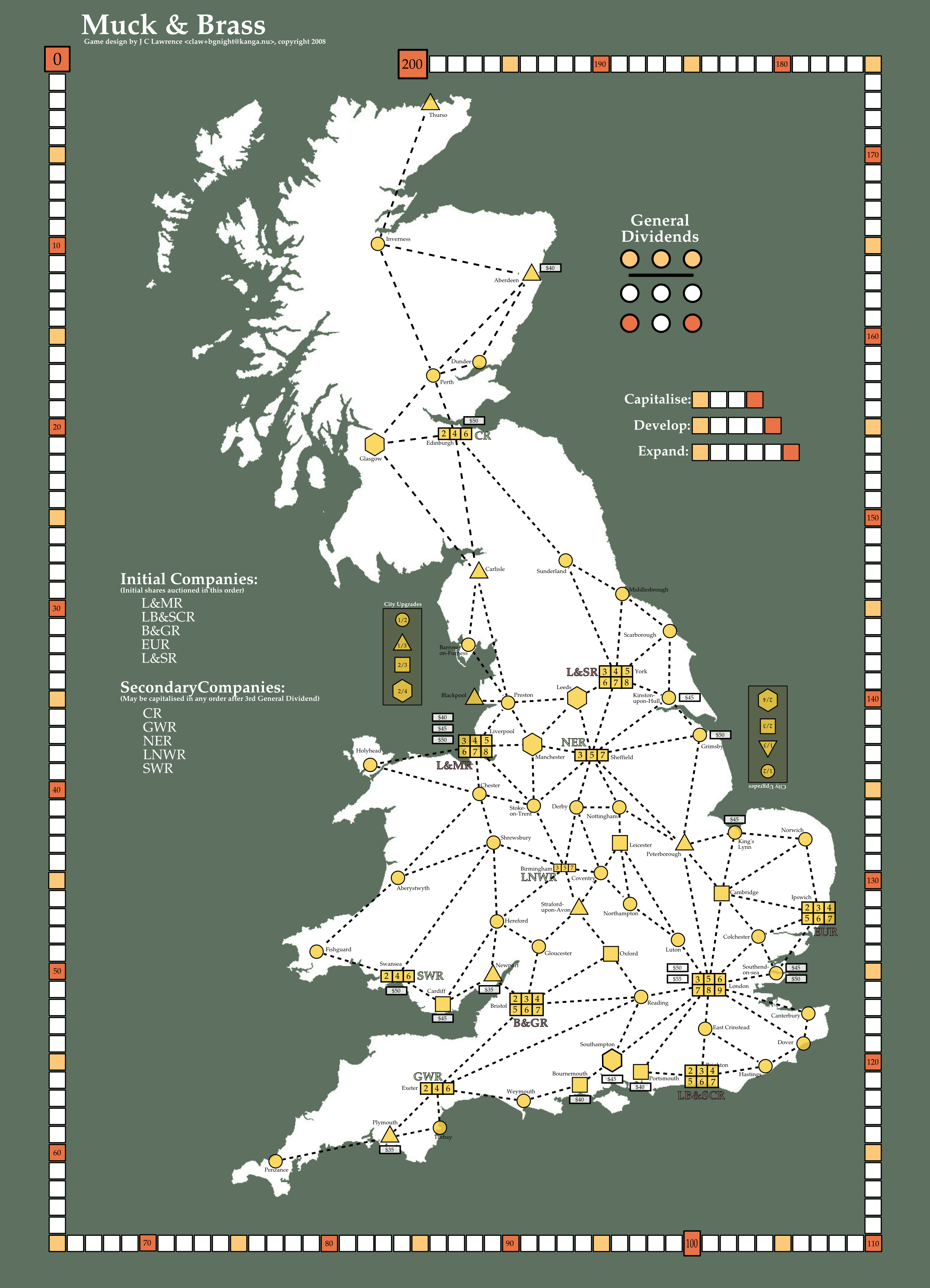

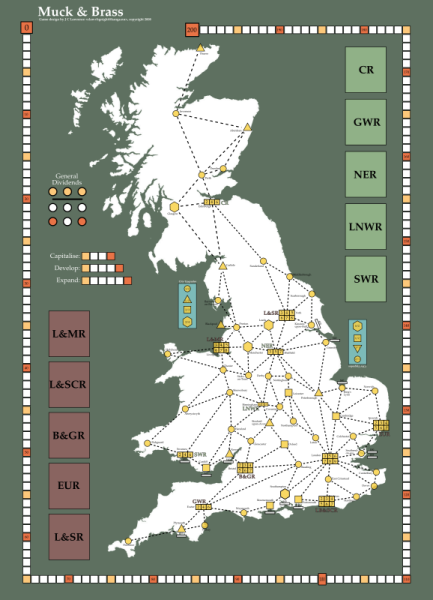

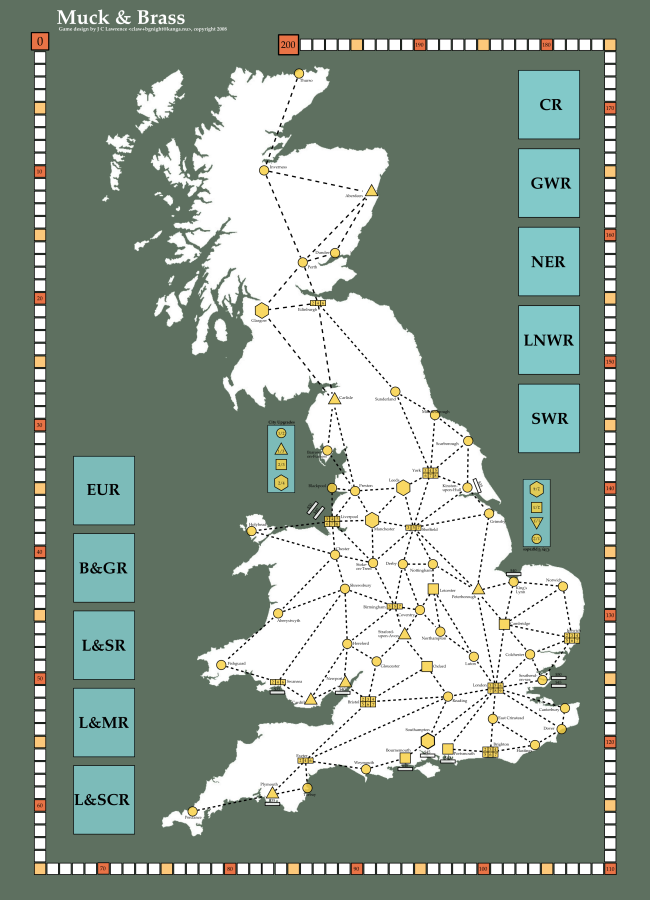

tables of initial and secondary home stations here

-

Route building costs are paid from the building company’s treasury to the bank

-

Routes may be built to the home station of a not-yet-operating company

-

A company may not build more than three connections from any city, and may not build all the connections from a city with more than two connections. These limits are only checked at the time of building track

-

The limits on railway track building change after the third General Dividend. Before the third General Dividend:

-

Only a single track link may be built each turn. The cost is $5

-

When track is built the building company’s income increases by the sum of the current values of the cities at the ends of the new track

-

Track may not be built to another active company’s home station

After the third General Dividend the following are also allowed:

-

A player owning a plurality of shares in a company may build two track links for a cost of $15:

- The first track build must connect the company network to a city which is not part of the entire company network and the second track build must connect that city to another city which is also not part of the entire company network. In the case of merged companies the networks of all component-companies are considered for both builds

- All track built with a double build must be for the same (component-) company

- Connecting to another company’s home station or to London immediately ends the Expand action (and may cause a merger, see Mergers)

- The company income is increased for each link as if each it were built separately

-

Foreign port connections may be built if the company is already connected to their city:

- Foreign port connections cost the price listed against them

- Foreign ports do not increase the income of the bulding company but do increase end-game share value (see [sub:Game-End] Game End)

- A route marker is placed on the port to indicate which company built it.

- Foreign ports may not be built as part of a double track build.

- Immediately after a foreign port is built the building company pays a Special Dividend (see Dividends)

-

When building track for a merged company, all track built must be for the same (component-) company

-

Track may be built to other company’s home stations. Connecting to another active company’s home station causes a merger (see Mergers)

Not the most brilliant piece of wordcraft I’ve done, but better than the exception heavy piece of paragraphed flat prose I’d before. I still need to make the language among links, connections, and track consistent among other changes.