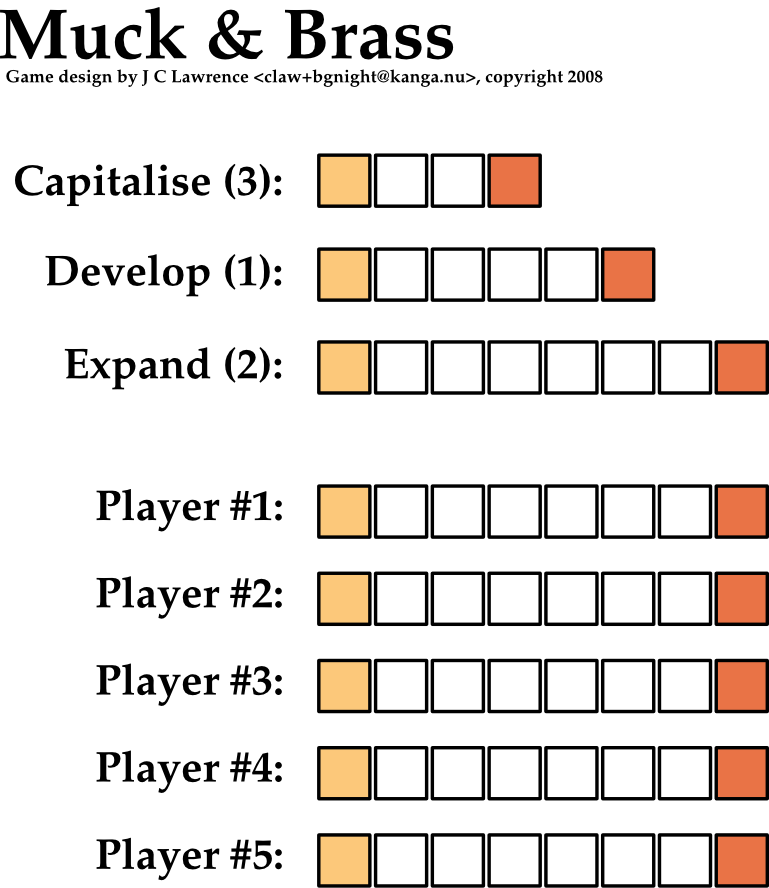

Share lessons

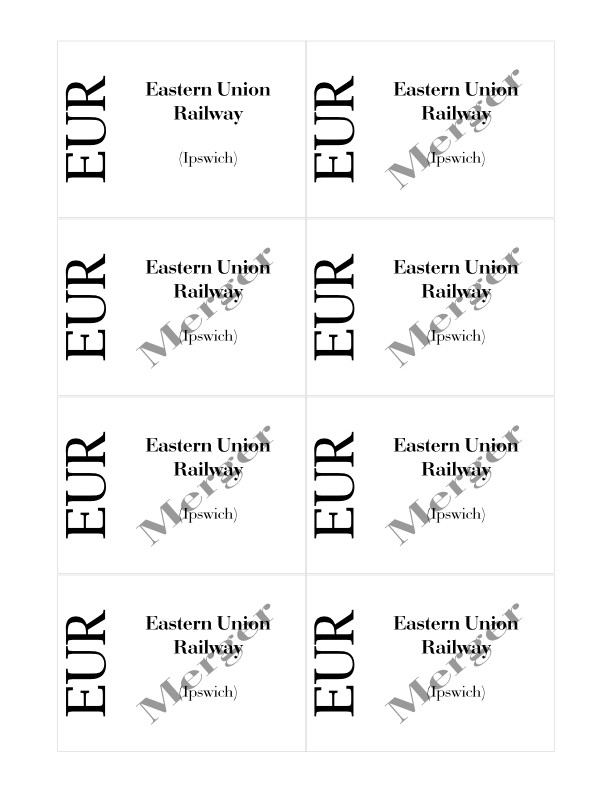

I made paper shares for Muck & Brass tonight using the share PDFs I genned yesterday. I don’t need them, the glass bits I have been using work well enough, but I suspect that a slightly crisper presentation (and demonstration of personal investment?) will make acceptance of a very early stage prototype easier.

A quick trip to an office supply store produced a pad of craft paper in 8 colours (sadly one of the colours was a very dark purple). A couple aisles over revealed two packs of copier paper in 5 colours, one set rather pastel and the other day-glo. I grabbed the craft paper and pastel sets, printed four sheets of each share sheet, cut them quickly with a Fiskar’s rotary cutter and slipped them into penny sleeves. 390 penny sleeves no less. However, they’re really quite nice. The paper colours are bold and clear, the black printing shows well, the company abbreviations on the ends of the shares allows them to be fanned easily (as often done in the 18XX) etc. Fair dinkum.

Meanwhile yesterday’s trip to the paper supply store revealed a business card cutter: feed printed stock in one end, turn the handle and out fall cut business cards. Cost ~$150. I suspect card production is not as trivial as it suggests and that a vice-based paper cutter remains the better choice there. Lastly, while business cards could make good shares/cards but there are narrow limitations on available stock colours and relatively high media costs. Bah.

The paper supply store also had a manual corner rounder for $300 (essentially a jig with a vice and a curved blade). It was a rather heavy-duty piece of equipment; likely to survive WWIII unscathed. it was tempting to be tempted. I have a hard time resisting such well-formed mechanical engineering. Thank the gods nobody is waving a Curta calculator in my face.

Lessons from tonight’s production run:

- Colour copier paper in a wide range of colours (I need 10 colours for the 10 companies in Muck & Brass) is readily available outside my local office supply stores (Stapes, Office Max, Office Depot etc). eg this store

- Sleeves are constant size. This can hide a multitude of sins surrounding cut shares not being of constant size.

- Craft paper is nice stuff to work with

- Craft paper easily jams in the printer. Treat it carefully and ensure the guides and feed are aligned well!

- Coloured copier paper is not so nice to work with, tending to crease, crumple and stick

- With a little care the rotary cutter will handle and cut stacks of 8 sheets well enough. That makes for 8 cuts for 64 shares. Not bad.

The goal is to play tomorrow at the Endgame Anniversary party. It isn’t likely, but worth a shot.