A tour around the Mersey

We played a four player teaching game of Muck & Brass last night and there were a few production-level problems. Until now I’d habitually played on a large map printed on a large format plotter. I’ve recently been rejiggering for maps produced on my HP K8600 and had so produced a reduced-size map for Muck & Brass, but hadn’t actually played on it. I had those nice big maps already in my game crate you see?

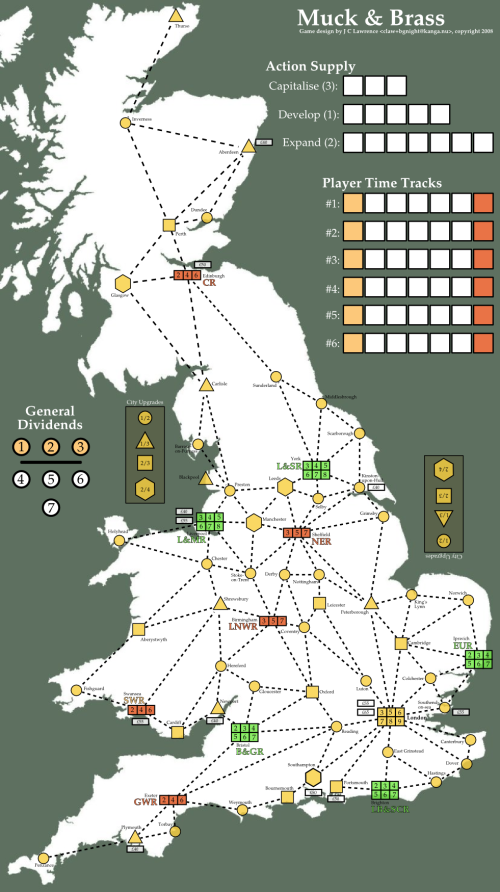

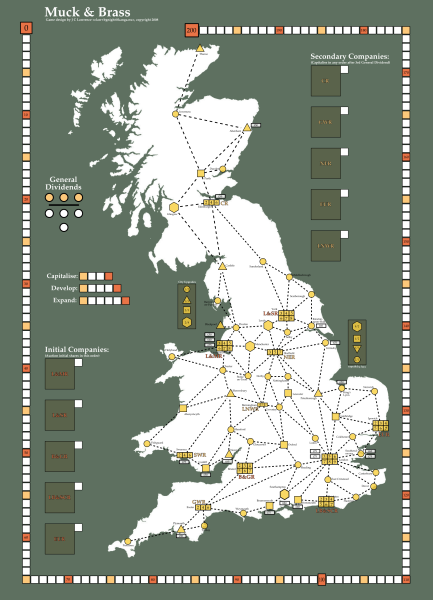

Well. last night we played on the new smaller map using 1cm cubes for everything (shares, track markers, player markers, etc) and the new smaller edition map was just a bit too small for convenience. Not a lot, but a bit. Another 15% or so would have made things ever so much more handy. The income tracks page had the same problem but rather more so. You see, my old big maps had nice big income and company treasury spaces on them:

The income track on the new smaller page isn’t really big enough to use 1cm cubes for income markers1, not conveniently, and the company spaces to hold the shares and treasury are actually rather perfectly sized in terms of things fitting but are quite poorly sized for telling what company they apply to once they’re in there, let alone handling the money for payments2 or moving shares about. Not so good there.

To that end I spent some time today scaling the map back up. It now fits and prints fairly comfortably on three sheets of US-Legal paper in landscape mode3. I used a 35 point overlap in my test run which seemed a fine value when I came to piece the three pages together. Happily that also puts the two joins that traverse the map in relatively visually convenient places. The income tracks etc are proving a little more troublesome. The company charter spaces need to be bigger (see below), the labling larger and outside the charter box, and the income track spaces at least 30% larger4.

I’m still fiddling with the new income track image and don’t yet have something I’m happy with. If it weren’t so damnably visually confusing and tempting to error I’d drop the income track idea entirely and just provide an income box to stack poker chips equal to the company’s current income.

The other lesson from last night’s game was that Capitalisation when early in the turn order is bad, but the reasons it is bad are not intuitive to players trained on more traditional German game fare. Rapid Capitalisation pushes money into the companies too fast for (that) player’s advantage and grants too much positional opportunity to players later in the turn order. Unlike Wabash Cannonball, Muck & Brass is not predominantly an auction game. When I ran through the reasoning and tempo and positional considerations around auction choices with the players post-game the light started to dawn, but only slowly. They intuitively saw the shares and auctions as a pricing and funding exercise, much as they’d been trained to in so many other German auction games, and not as an income and positional advantage management problem. When I got to the bit of how having money is desperately important, especially in the early game in Muck & Brass, they nodded understandingly, but when I then continued onto how having less money (cash) than the other players is in some ways even more important due to timing-related positional advantages I lost them. The players also did not understand the tactical advantages of port builds versus mergers. Again the patterns are fairly obtuse. They understood the words, they understood the sentences, but even when I walked through an example post-game the lights didn’t come on. Again this seems like habituation from prior standard German faire: of course players advance their most differentiated investments as that’s where their deltas are! Much like the weakness of large investments in Age of Scheme: Routes to Riches and the far larger value of minor investments in that game, the merger/port choice puts the focus and value on profiting through minor investment incentives, not through major investments. As a designer I (self-servingly?) don’t see their incomprehension as a problem, more evidence of the game having both a learning curve and potential tactical depth.

Even with all the early Capitalisations and thus the super-funding of the companies and the resulting loss of tension in the early game as the struggle among positional advantage, turn-order and investment portfolio was (mostly) lost, it actually worked pretty well. The game ended in the fourth round and the game was (effectively) dictated by the division of the super-treasury of the mega-merged company. That was a little disappointing but it was also clear to the players how that had occurred and they had ideas as to what to do about it next time. That was pleasing – and reminiscent of our early days with Wabash Cannonball.

Play time was a little under 90 minutes including rules teaching. I took a few pictures of the game and will post them later. Meanwhile Tim Harrison has questioned the action divisions across player counts. I recall working it out but I should review it again and ensure it is right.

-

I’d drawn it intending to use Settlers of Catan-style road bits for income markers, but using the same 1cm bits for income markers and shares is just too delightfully simple. ↩

-

I assume standard-sized poker chips. ↩

-

It will be a bit tougher on Europeans who will likely have to resort to a couple sheets of A3 and to scale the map down slightly to fit the marginally reduced height. ↩

-

Corporate incomes for aggressively merged companies will commonly approach 100 and in slightly unusual cases will approach and possibly even exceed 200. The big-image income track thus runs from 0 - 200. The small income track runs from 0-100 and assumes that players will keep track of whether a given marker indicates an income of <100, 100+ or 200+. I’m likely to continue assuming that. ↩